Risk management - Business schedule risk

Business schedule risk

In its simplest form, for each identified opportunity, you need to know:

- An idea of the likelihood of the opportunity coming to fruition.

- The start time of the project. This will govern cash flow.

- Duration of the project.

From this simple data you can start to map the revenue and costs over the year showing net cash flow leading to profit forecasts.

You can do this on a monthly basis.

You can do this for the project opportunities as a whole over the year or via market segments e.g. geographical.

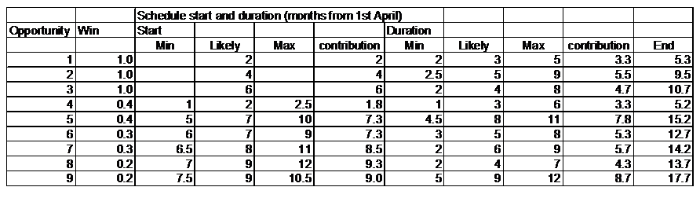

How is the table above constructed and what does it mean?

General

The table represents a list of opportunities when they will start, their durations and hence their end dates.

Opportunity

List of known and potential projects.

Win

Here we put our best assessment of the likelihood of getting the contract for the project.

These values will be used in calculations to weight the contribution to the profit [see business revenue and profit risk].

A value = 1.0 means that it is a certainty and either the contract is signed or it is already in progress.

Start

The values shown are in months.

In this particular case you are entering the ‘number of months’ from 1st April that each Opportunity will begin.

For Opportunity 2 we have 4 months from 1st April which would be 1st July.

Of course, you could have calculated the timing from any date and 1st January would be an alternative depending on when the financial year runs in your company.

This is the estimate of when the projects may begin.

In the case of those with a win probability of 1.0 the start time will be known.

In the above example, opportunities 1,2 and 3 just have LIKELY values.

In these cases we know when they will start.

The others are given 3 point estimates and the contribution is calculated as in previous examples.

If we look at Opportunity 4:

Contribution = (1 + 2 + 2.5)/3 = 5.5/3 = 1.8.

That is you estimate that the project will start 1.8 months after beginning of the financial year.

Duration

In similar fashion, we need to add 3 point estimates for the durations of each of the opportunities.

Carrying on the example of Opportunity 4:

Contribution = (1 + 3 + 6)/3 = 10/3 = 3.3.

The end date will be the sum of the contributions So, for Opportunity 4:

Start contribution + duration contribution = 1.8 + 3.3 = 5.2 (when calculated accurately to 1 decimal place).

We have now completed the 3 point estimates for the list of 9 opportunities and we now need to look at the revenue [see business revenue and profit risk].